For Week Ending March 18, 2023

For Week Ending March 18, 2023

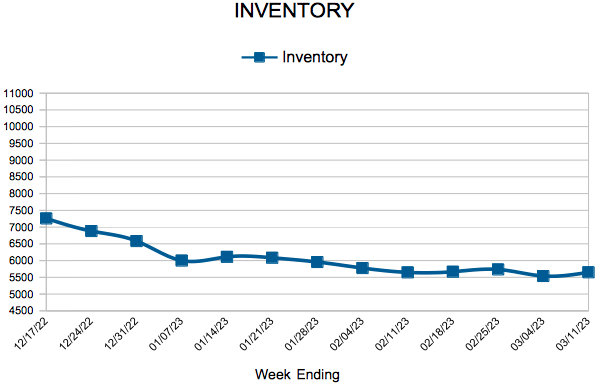

More than a decade of underbuilding has resulted in a shortage of 6.5 million single-family homes, as new-home construction continues to lag population growth. According to a new report from Realtor.com, 15.6 million new households were formed between 2012 and 2022, while only 9.03 million new single-family homes were completed. However, the report acknowledges that if multi-family starts are included, which represented 35% of all housing starts in 2022, the current supply deficit falls to 2.3 million homes.

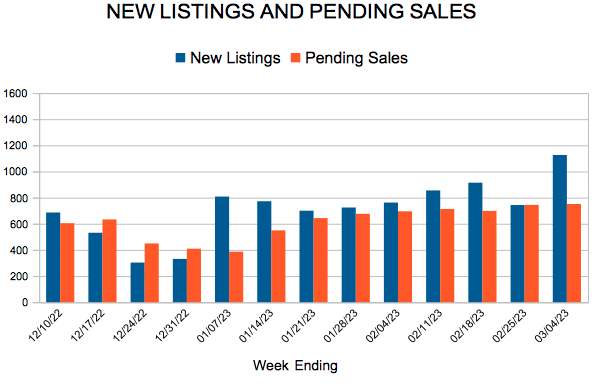

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 18:

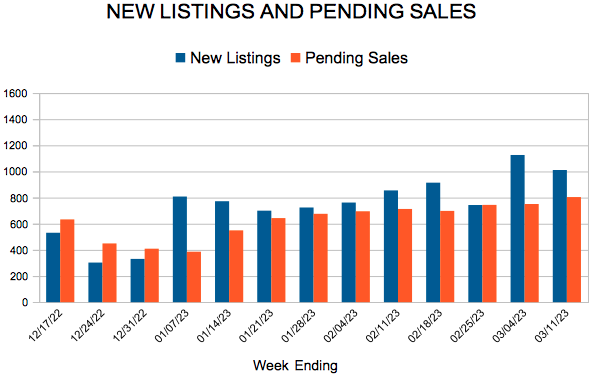

- New Listings decreased 29.9% to 1,006

- Pending Sales decreased 27.7% to 850

- Inventory increased 10.8% to 5,743

FOR THE MONTH OF FEBRUARY:

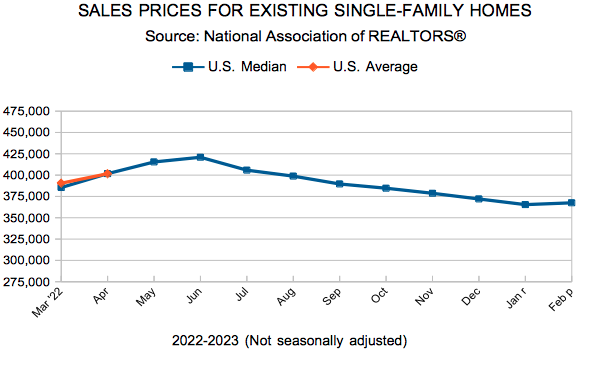

- Median Sales Price increased 0.6% to $342,000

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.