December 24, 2025

The average 30-year fixed-rate mortgage decreased further this week. Declining rates offer a timely and welcome gift for aspiring homebuyers.

- The 30-year fixed-rate mortgage averaged 6.18% as of December 24, 2025, down from last week when it averaged 6.21%. A year ago at this time, the 30-year FRM averaged 6.85%.

- The 15-year fixed-rate mortgage averaged 5.50%, up from last week when it averaged 5.47%. A year ago at this time, the 15-year FRM averaged 6.00%.

Information provided by Freddie Mac.

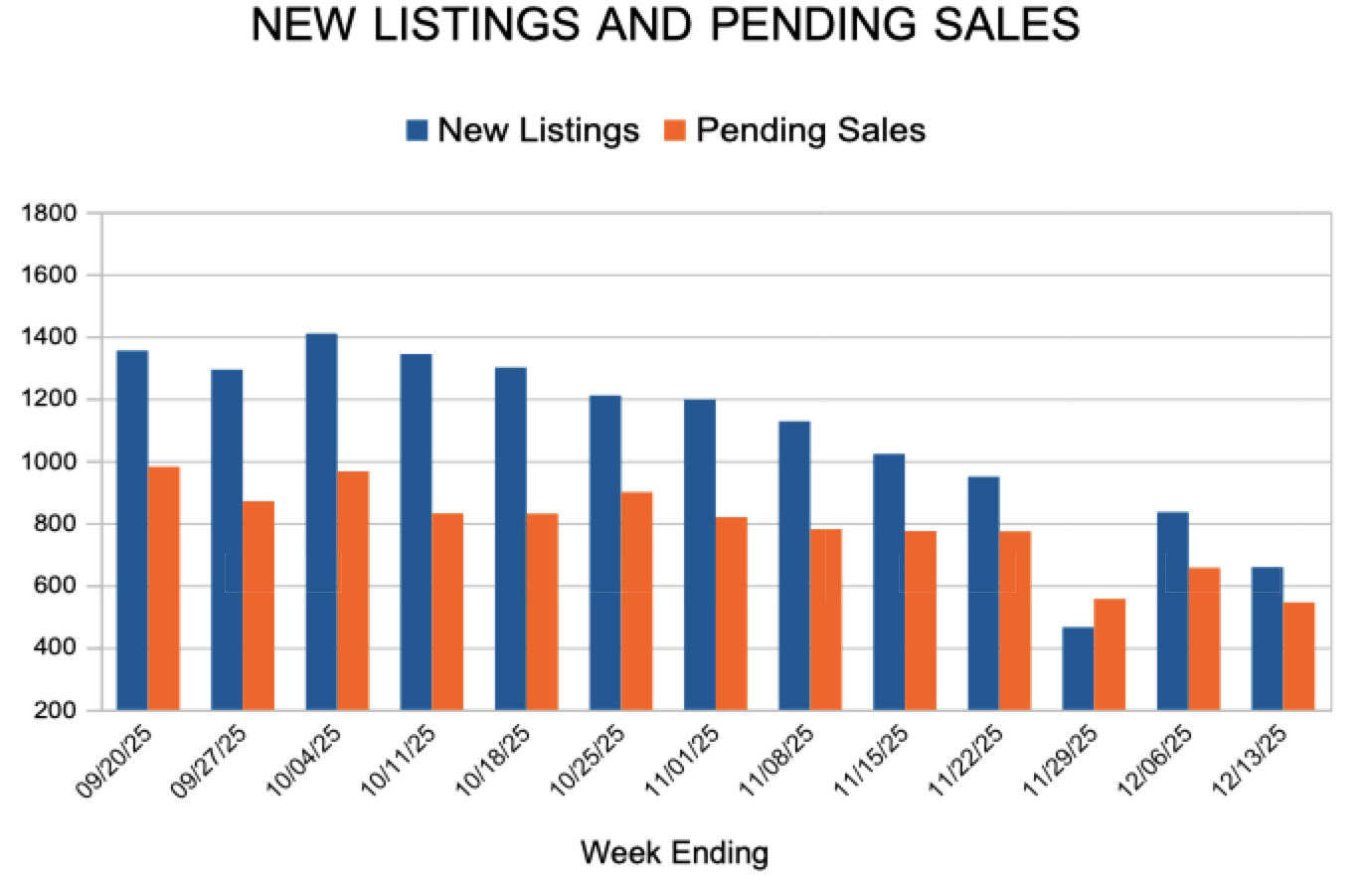

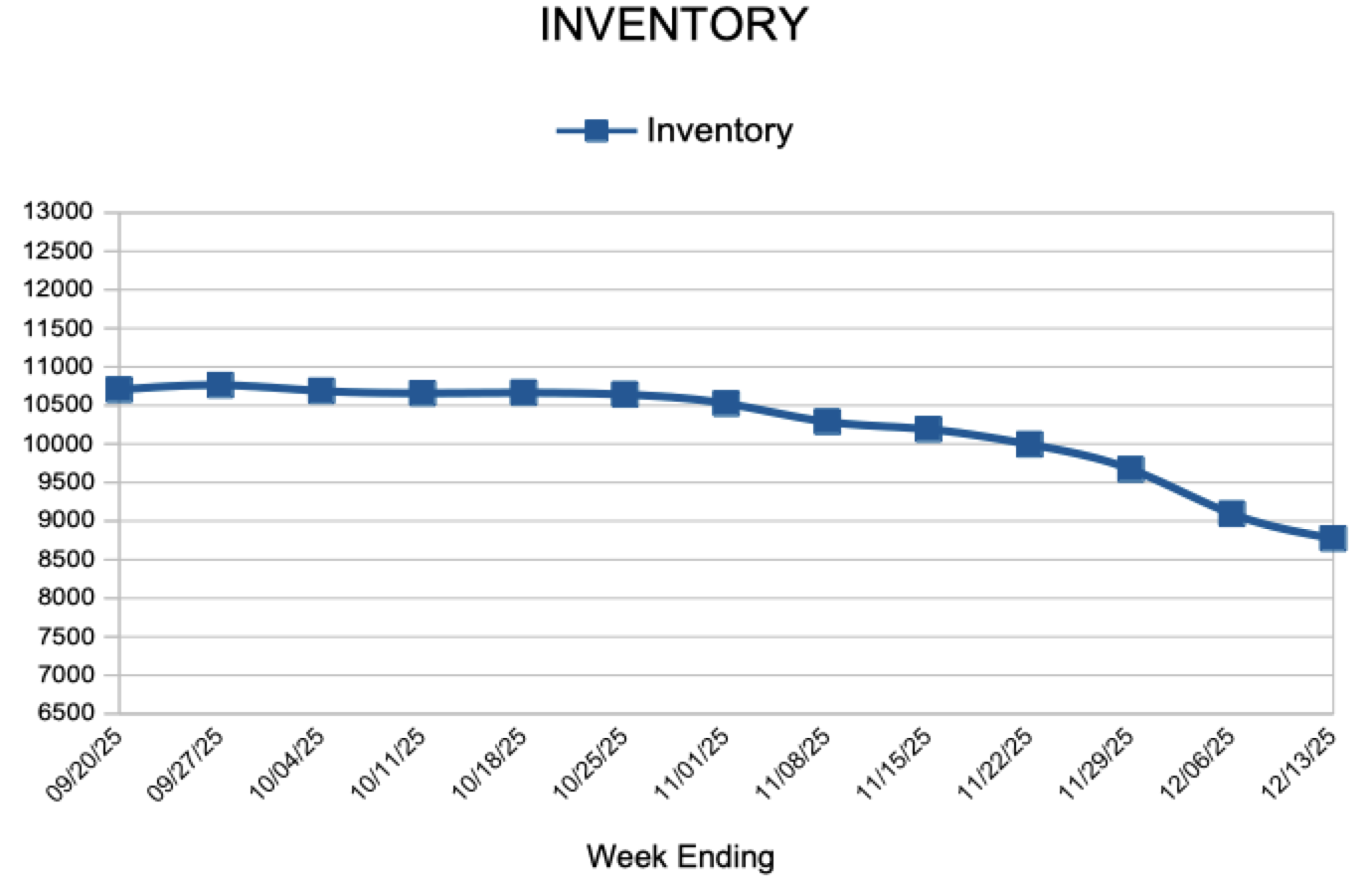

For Week Ending December 13, 2025

For Week Ending December 13, 2025