July 11, 2024

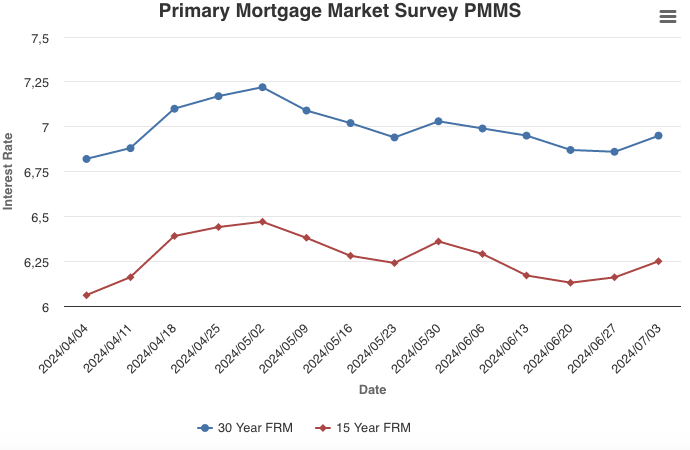

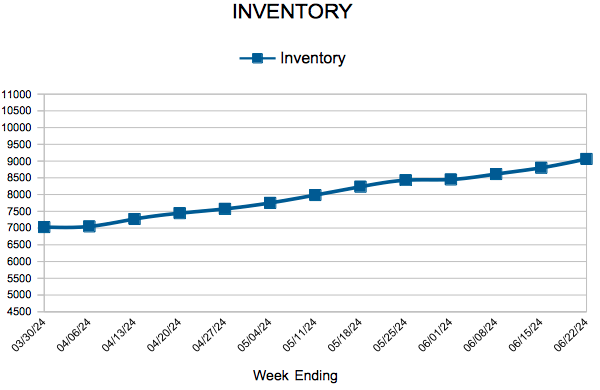

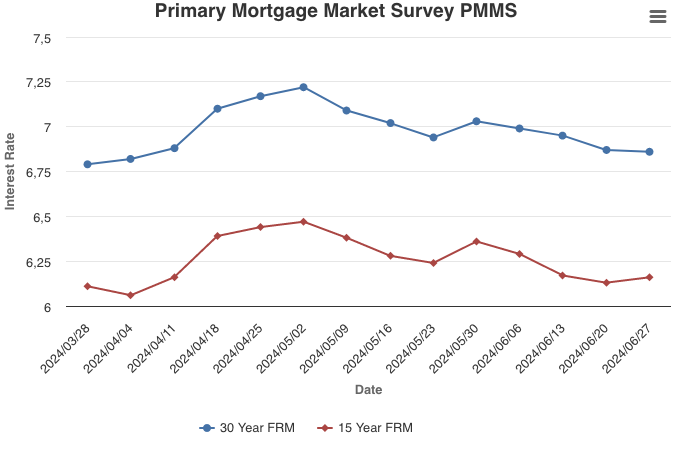

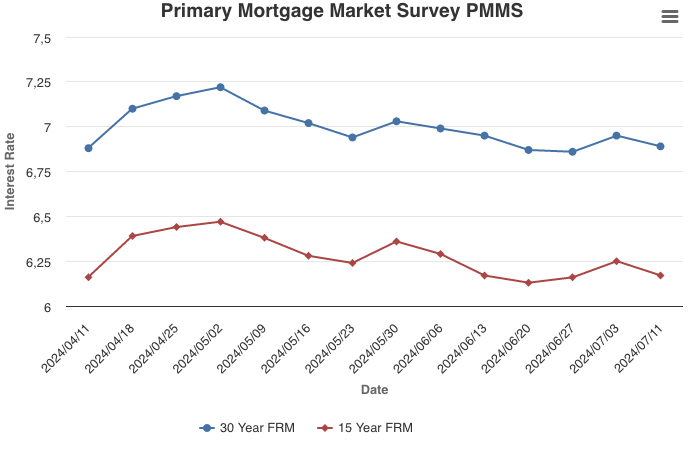

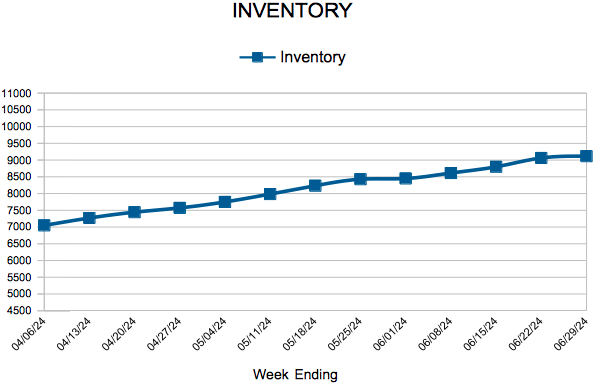

Following June’s jobs report, which showed a cooling labor market, the 10-year Treasury yield decreased this week and mortgage rates followed suit. There is also more inventory on the market, including a fair number of listings with price cuts, which is an encouraging sign for prospective buyers.

Information provided by Freddie Mac.

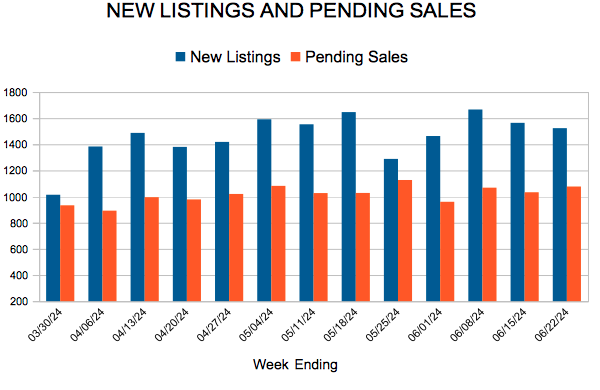

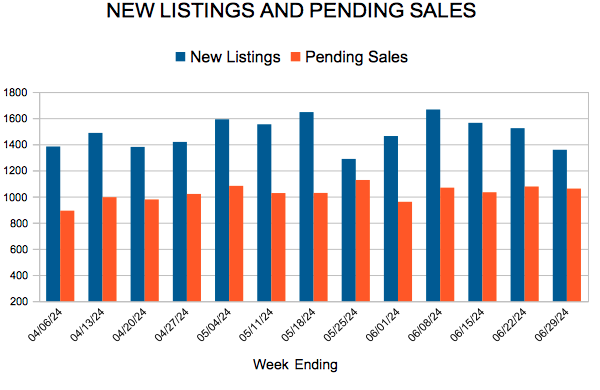

For Week Ending June 29, 2024

For Week Ending June 29, 2024