For Week Ending June 1, 2024

For Week Ending June 1, 2024

The average American household spent 24.2% of their income on mortgage payments in the first three months of the year, according to the National Association of REALTORS®, down from 26.1% the previous quarter. Assuming a 20% down payment, the typical monthly mortgage payment on an existing single-family home was $2,037 in the first quarter, an increase of 9.3%, or $173 per month, compared to the same period a year ago.

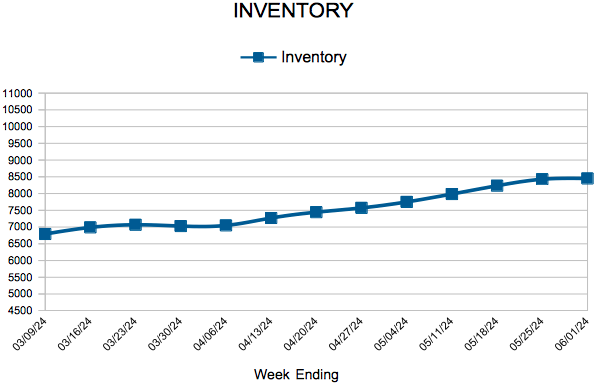

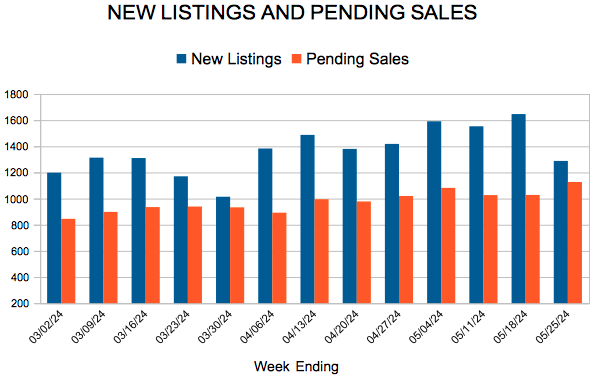

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 1:

- New Listings decreased 3.8% to 1,463

- Pending Sales decreased 5.0% to 960

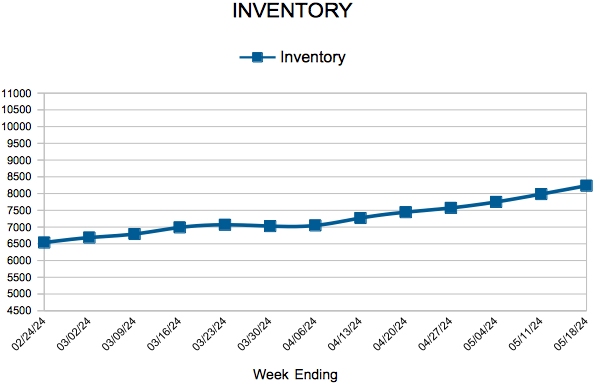

- Inventory increased 14.0% to 8,450

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

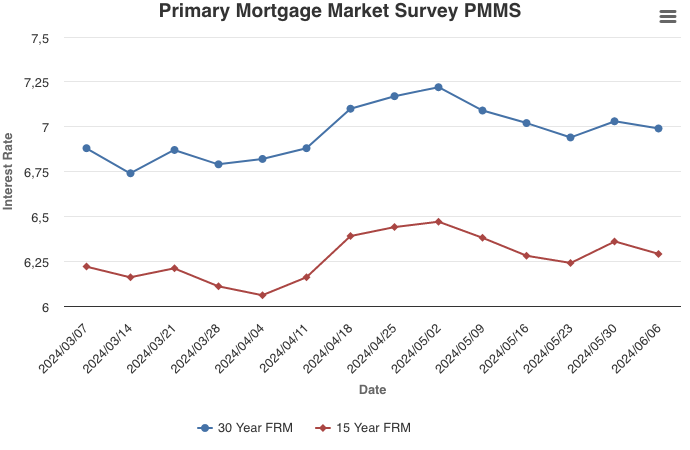

June 6, 2024

Mortgage rates retreated this week given incoming data showing slower growth. Rates are just shy of seven percent, and we expect them to modestly decline over the remainder of 2024. If a potential buyer is looking to buy a home this year, waiting for lower rates may result in small savings, but shopping around for the best rate remains tremendously beneficial.

Information provided by Freddie Mac.

For Week Ending May 25, 2024

For Week Ending May 25, 2024

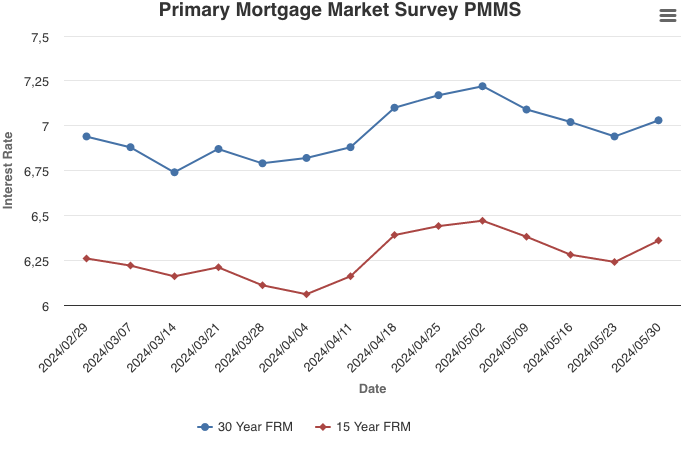

Prospective homebuyers received good news recently in the form of declining mortgage rates, which fell for the third consecutive week, offering consumers some relief amid persistent affordability challenges. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.94% the week ending May 23, down from 7.02% the week before, marking the first time since early April that rates have fallen below 7%.

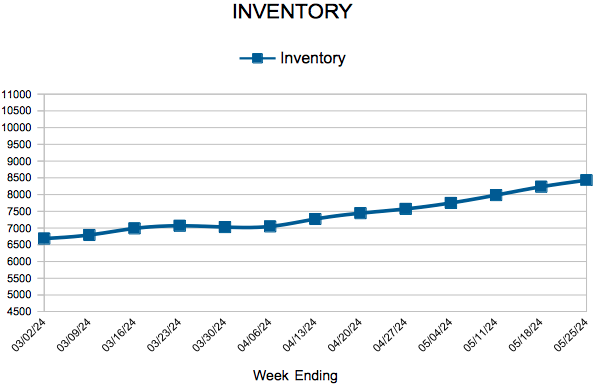

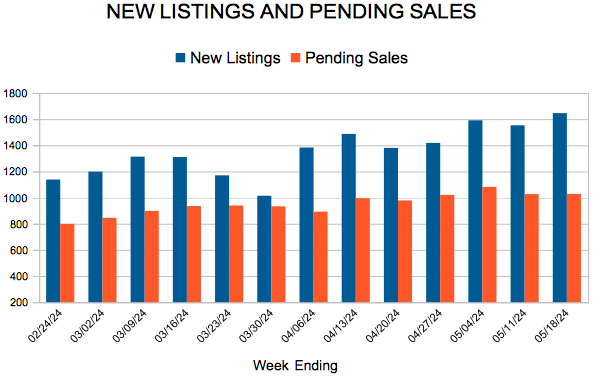

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 25:

- New Listings decreased 9.4% to 1,288

- Pending Sales decreased 6.6% to 1,127

- Inventory increased 14.9% to 8,428

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

May 30, 2024

Following several weeks of decline, mortgage rates changed course this week. More hawkish commentary about inflation and tepid demand for longer-dated Treasury auctions caused market yields to rise across the board. This reality, as well as economic signals that have moved sideways over the last few weeks, have resulted in mortgage rates drifting higher as markets continue to dial back expectations of interest rate cuts.

Information provided by Freddie Mac.