For Week Ending September 9, 2023

For Week Ending September 9, 2023

Mortgage applications fell to their lowest level since 1996, with total mortgage applications dropping 0.8% from the previous week, according to the Mortgage Bankers Association (MBA), as higher mortgage interest rates continue to take their toll on market participants. Applications to purchase a home were 27% lower than the same week a year ago, while demand for refinances was down 31% compared to the same week last year.

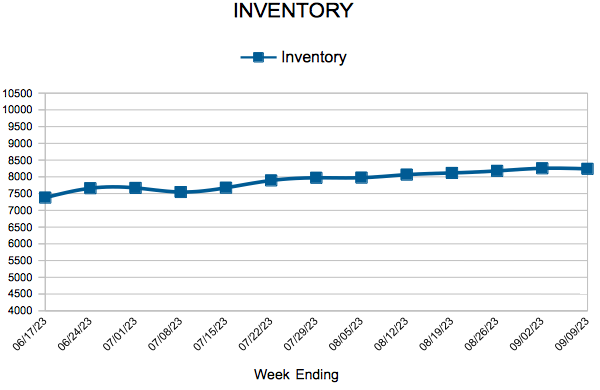

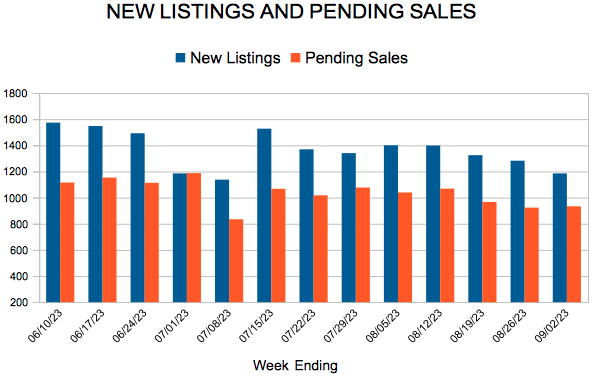

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 9:

- New Listings decreased 2.4% to 1,400

- Pending Sales decreased 16.7% to 692

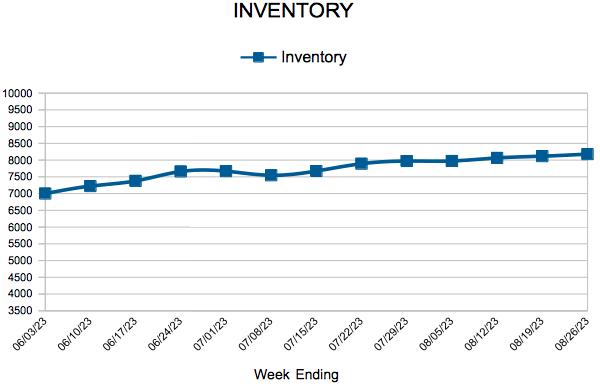

- Inventory decreased 10.3% to 8,239

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

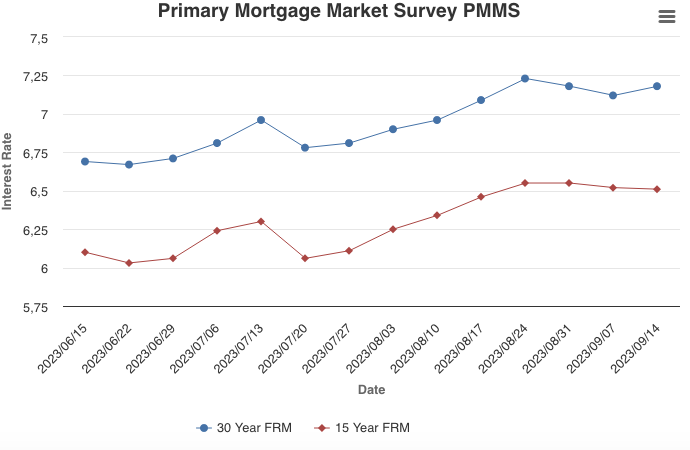

September 14, 2023

Mortgage rates inched back up this week and remain anchored north of seven percent. The reacceleration of inflation and strength in the economy is keeping mortgage rates elevated. However, potential homebuyers can still benefit during these times of high mortgage rates by shopping around for the best rate quote. Freddie Mac research suggests homebuyers can potentially save $600-$1,200 annually by applying for mortgages from multiple lenders.

Information provided by Freddie Mac.

For Week Ending September 2, 2023

For Week Ending September 2, 2023

The lack of existing-home inventory continues to boost demand for new construction homes, and U.S. homebuilders are ramping up production to help meet buyers’ needs. According to the U.S. Census Bureau, total housing starts rose 3.9% month-over-month to a seasonally adjusted rate of 1.452 million, and were up 5.9% from the same period last year, exceeding economists’ expectations. Much of the increase was due to single-family starts, which grew 6.7% month-over-month, led by gains in the Midwest and West regions.

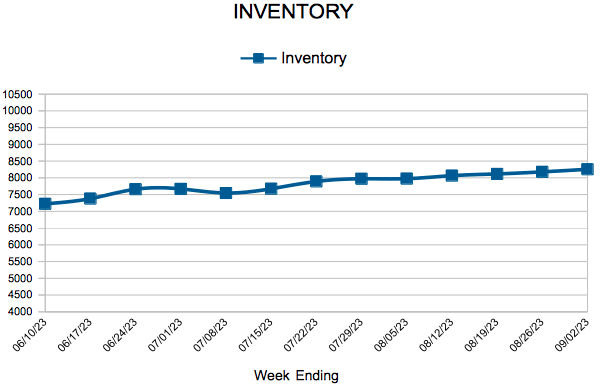

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 2:

- New Listings decreased 2.1% to 1,185

- Pending Sales decreased 6.1% to 933

- Inventory decreased 11.3% to 8,255

FOR THE MONTH OF JULY:

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

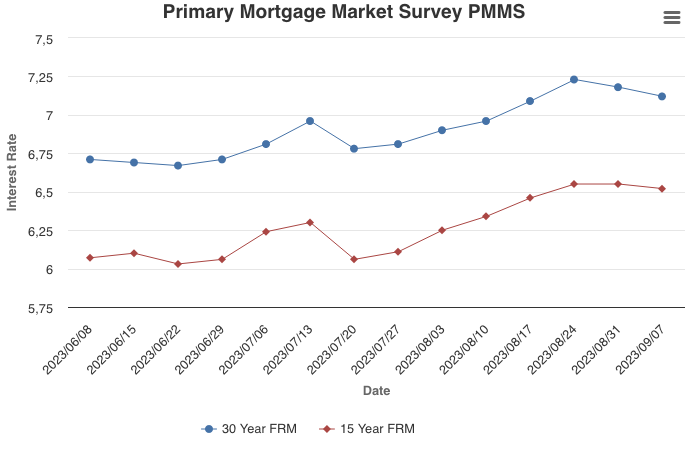

September 7, 2023

For the fourth consecutive week, the 30-year fixed-rate mortgage hovered above seven percent. The economy remains buoyant, which is encouraging for consumers. Though while inflation has decelerated, firmer economic data have put upward pressure on mortgage rates which, in the face of affordability challenges, are straining potential homebuyers.

Information provided by Freddie Mac.

For Week Ending August 26, 2023

For Week Ending August 26, 2023

U.S. home equity recently hit a 4-year high, with nearly half of all mortgage borrowers considered equity rich—having a loan to value ratio of 50% or lower—in the second quarter of this year. According to ATTOM’s Q2 2023 U.S. Home Equity and Underwater Report, 49% of mortgaged residential homes were equity rich, up from 47% in the first quarter of the year, with quarterly increases found in 45 states. The highest levels of equity-rich mortgaged properties continue to be found in the West, with six of the top 10 states in the second quarter located in that region.

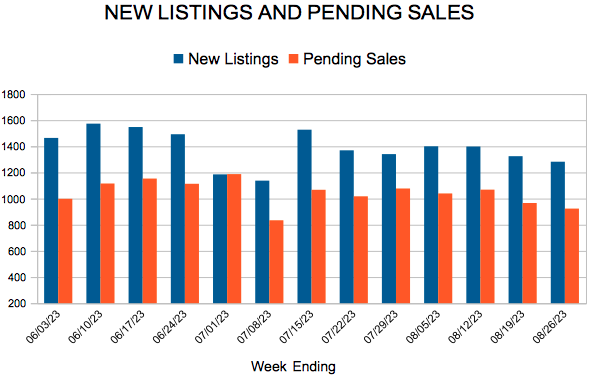

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 26:

- New Listings increased at 1,282

- Pending Sales decreased 9.2% to 923

- Inventory decreased 12.7% to 8,178

FOR THE MONTH OF JULY:

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.