- The median sales price was unchanged at $355,000

- The average market time was up 62.9 percent to 57 days

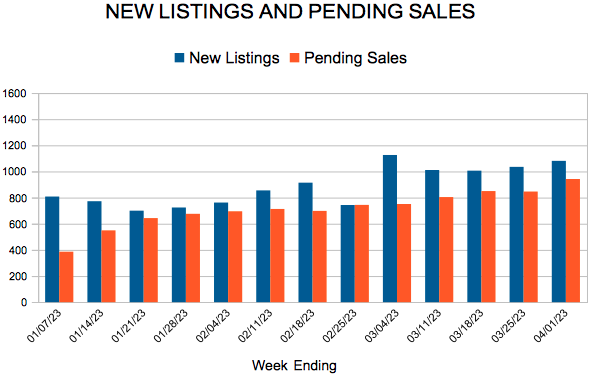

- New listings down 23.9 percent; pending sales down 27.9 percent

(April 14, 2023) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, home prices flattened out and held steady from last March. The metro’s median sales price stands at $355,000. Buyer and seller activity are still down around 25.0 percent from year-ago levels.

Sales & Listings

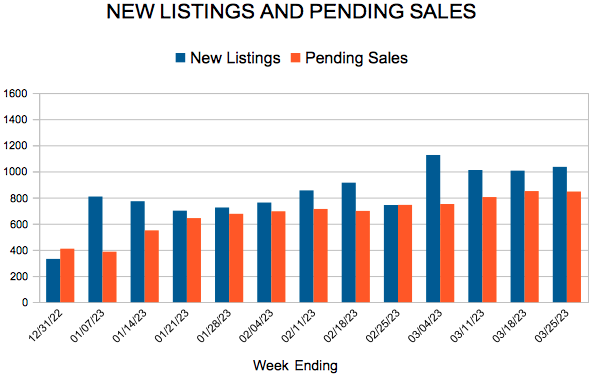

In March, sellers brought 4,980 new listings online which amounted to 23.9 percent fewer than last year. Of those and other active listings that sold, half lasted fewer than 27 days on market. That may seem high compared to last year’s figure of 12 days on market, but it’s in line with 2018, 2019 and 2020 for this time of year. This is another sign that normalizing demand has had a stabilizing effect on the market.

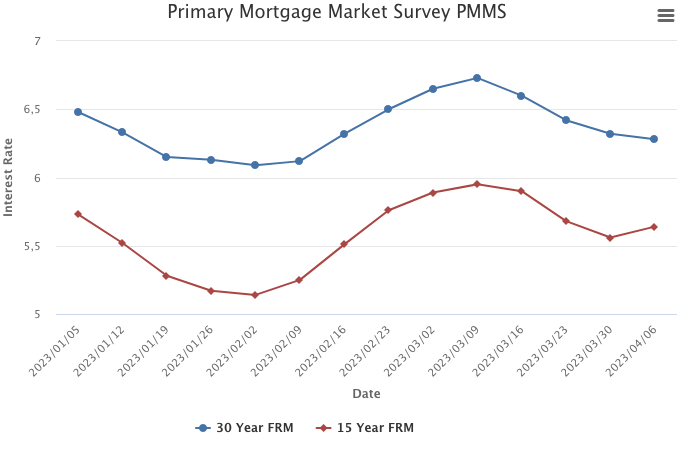

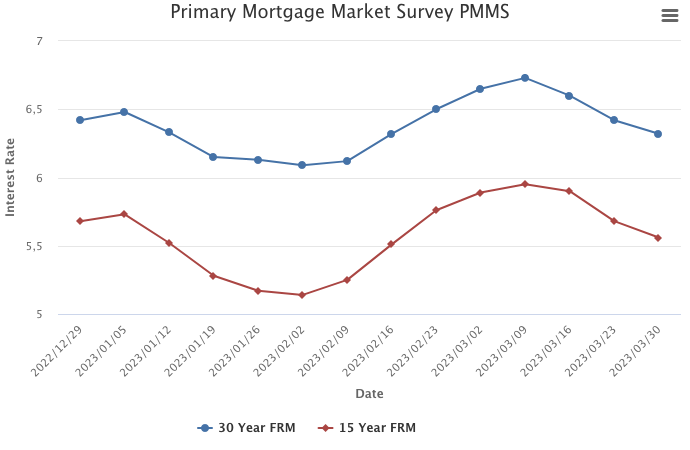

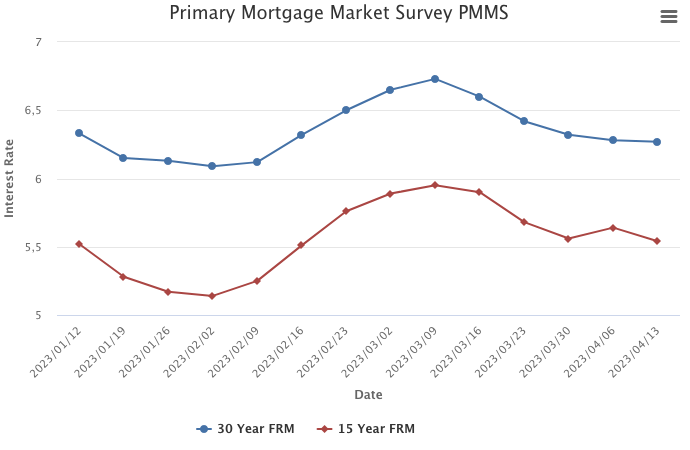

“While we do still see some competition for the most desirable listings, buyers don’t feel quite as rushed as they did a year or so ago, and they are being more selective,” said Jerry Moscowitz, President of Minneapolis Area REALTORS®. “The challenge now is on the monthly payment side which has forced buyers to think more critically about their options and budget.” Buyer activity continued to decline in the wake of the Federal Reserve’s rate hiking campaign, which has increased the cost of borrowing notably. Last month, buyers signed 3,767 purchase agreements, 27.9 fewer than a year ago. It was a similar story for closings—the 3,156 closed deals in March were down 20.5 percent. Largely because of rising rates, home sales have now seen 10 consecutive months of double-digit year-over-year declines that started in June 2022.

This means that sellers have had to adjust their expectations. There’s at least two sides to every story, and what’s seen as a return to normal for some could also be viewed as a downturn from a seller’s perspective. Sellers accepted an average of 98.6 percent of their list price compared to 102.7 percent last year. Price negotiations have moved slightly in buyers’ favor. But overall, the balance of the market has remained relatively tight because both buyer and seller activity have downshifted in tandem.

Inventory & Home Prices

The increases in home prices have dissipated as buyer activity has come down from record highs. Bidding wars have eased but not disappeared. “Even as sales have slowed from record highs, motivated buyers are out there but not to the same degree as recently,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “That means prices aren’t being pushed up like they were. This is welcomed news for buyers, but sellers are still getting solid offers in a reasonable timeframe.”

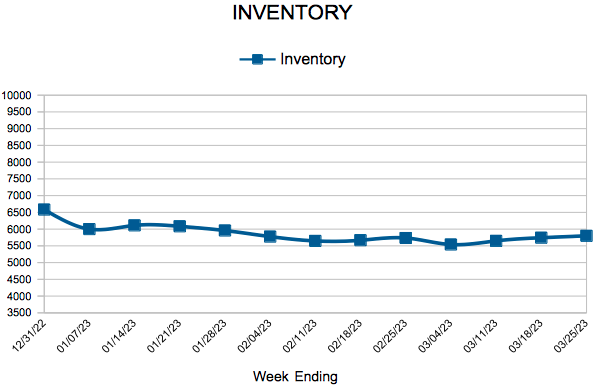

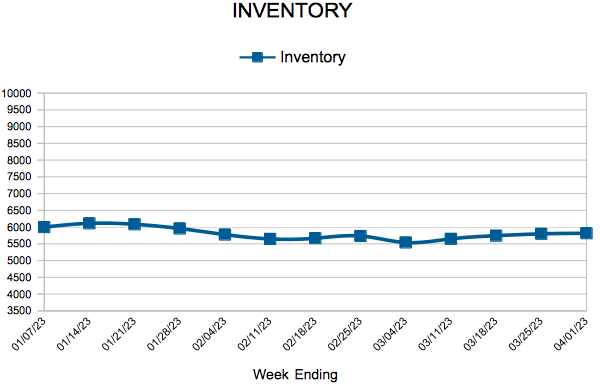

The Twin Cities metro is still technically in a seller’s market, just not to the same degree as last year. There were 5,769 homes available for sale at the end of March, or 2.1 percent more than last year. Since buyer demand has waned and our inventory rose slightly, March’s month’s supply of inventory was up 27.3 percent. That meant we had 1.4 months’ supply of inventory at the end of the month. Typically 4-6 months of supply are needed to reach a balanced, neutral market.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 6.7 percent while existing home sales were down 21.1 percent. Single family sales fell 22.0 percent, condo sales declined 28.9 percent and townhome sales were down 3.9 percent. Sales in Minneapolis decreased 26.0 percent while Saint Paul sales fell 21.9 percent. Cities like Watertown, Victoria, Mendota Heights, Blaine and Hudson saw the largest sales gains while Robbinsdale, Mound, Isanti and New Richmond all had notably lower demand than last year.

March 2022 Housing Takeaways (Compared To A Year Ago)

- Sellers listed 4,980 properties on the market, a 23.9 percent decrease from last March

- Buyers signed 3,767 purchase agreements, down 27.9 percent (3,207 closed sales, down 20.5 percent)

- Inventory levels grew 2.1 percent to 5,769 units

- Month’s Supply of Inventory rose 27.3 percent to 1.4 months (4-6 months is balanced)

- The Median Sales Price was flat at $355,000

- Days on Market rose 62.9 percent to 57 days, on average (median of 27 days, up 125.0 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 22.0 percent; Condo sales were down 28.9 percent & townhouse sales fell 3.9 percent

- Traditional sales declined 20.1 percent; foreclosure sales rose 11.1 percent; short sales increased 42.9 percent

- Previously owned sales decreased 21.1 percent; new construction sales declined 6.7 percent

For Week Ending April 1, 2023

For Week Ending April 1, 2023