For Week Ending January 14, 2023

For Week Ending January 14, 2023

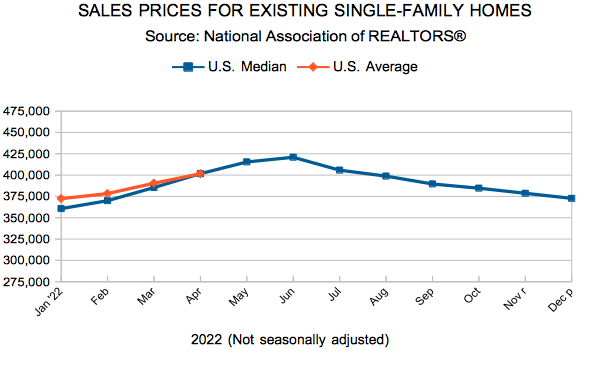

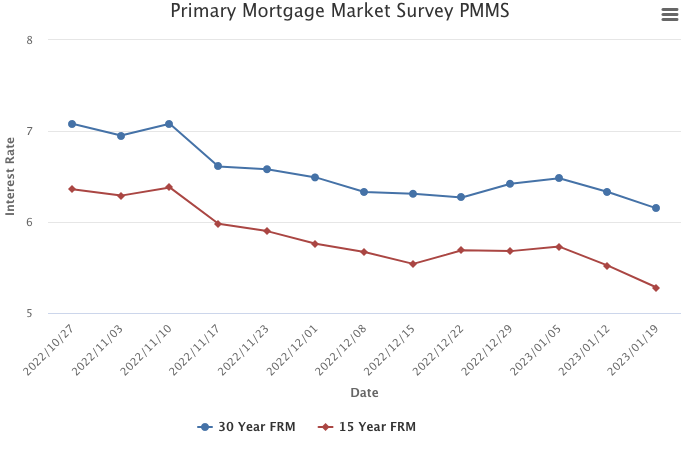

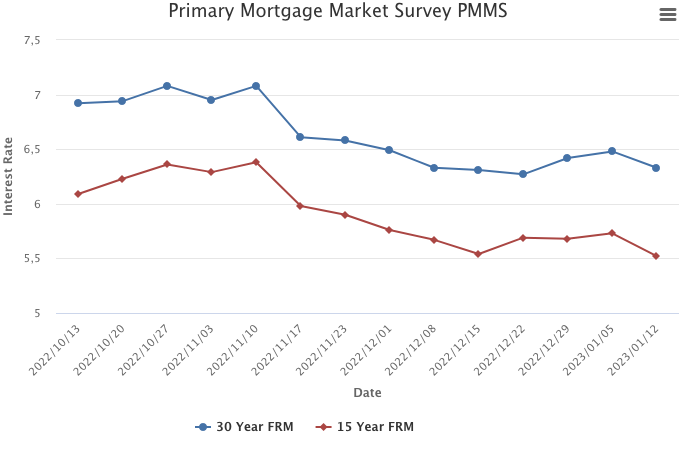

Despite softening home prices, housing affordability continued to decline nationwide in Q4 2022 due in part to elevated interest rates. According to ATTOM’s Q4 2022 U.S. Home Affordability Report, median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide, an increase from Q4 2021, when 68% of counties were less affordable. The portion of wages needed for homeownership costs also increased, with homeownership costs now requiring 32.3% of the average national wage, a 15-year high.

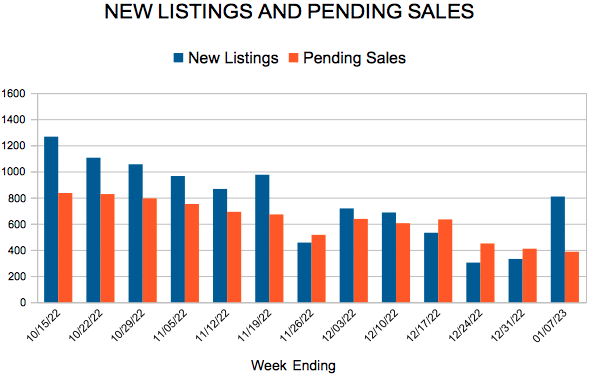

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 14:

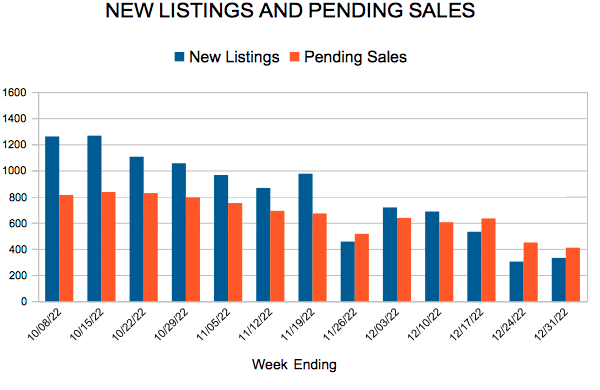

- New Listings decreased 5.6% to 772

- Pending Sales decreased 25.6% to 549

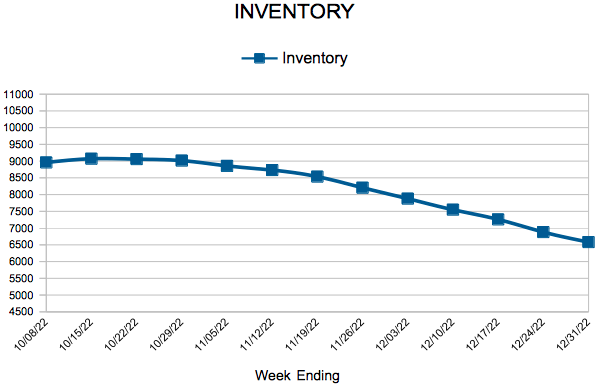

- Inventory increased 21.3% to 6,111

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 4.9% to $347,900

- Days on Market increased 47.1% to 50

- Percent of Original List Price Received decreased 3.2% to 96.3%

- Months Supply of Homes For Sale increased 55.6% to 1.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.