For Week Ending November 6, 2021

For Week Ending November 6, 2021

Cash-out refinances are up 33% from October last year, Black Knight reports, as Americans seek to take advantage of low interest rates and double-digit gains in home equity over the pandemic. Driven by soaring home values, U.S. tappable home equity reached 9.1 trillion dollars in October, prompting an increasing number of borrowers to cash out some of their equity for debt consolidation, investment purposes, home improvement projects, and more.

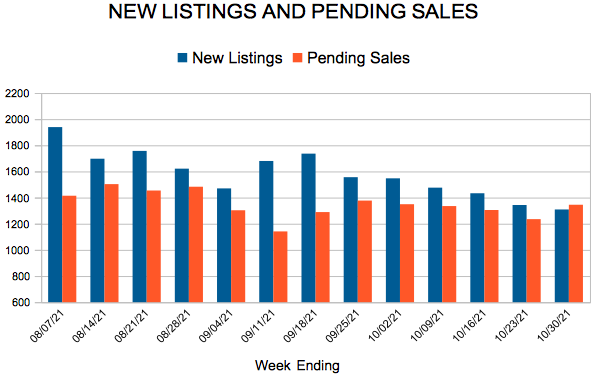

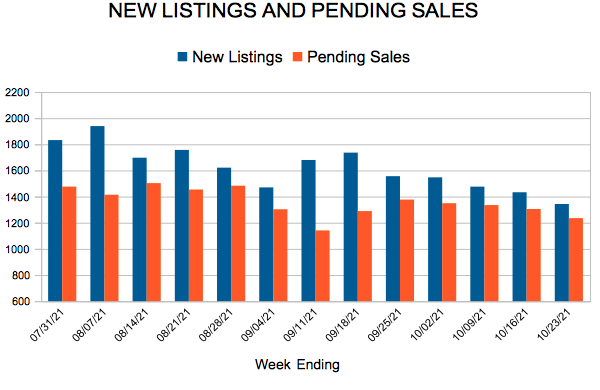

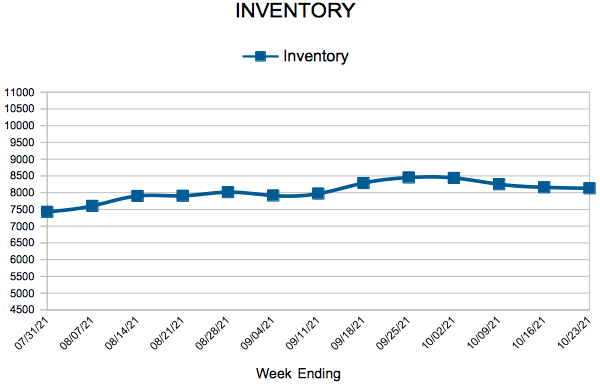

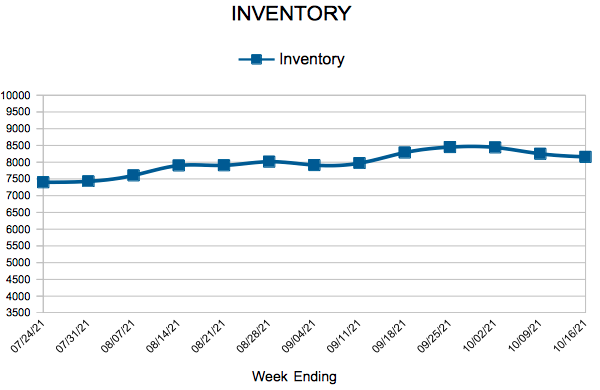

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 6:

- New Listings decreased 4.2% to 1,217

- Pending Sales decreased 6.0% to 1,178

- Inventory decreased 14.6% to 7,640

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.