October 9, 2025

Mortgage rates decreased this week. Over the last few weeks, mortgage rates have settled in at their lowest level in about a year. There is growing evidence that homebuyers are digesting these lower rates and gradually are willing to move forward with buying a home, which is boosting purchase activity.

Information provided by Freddie Mac.

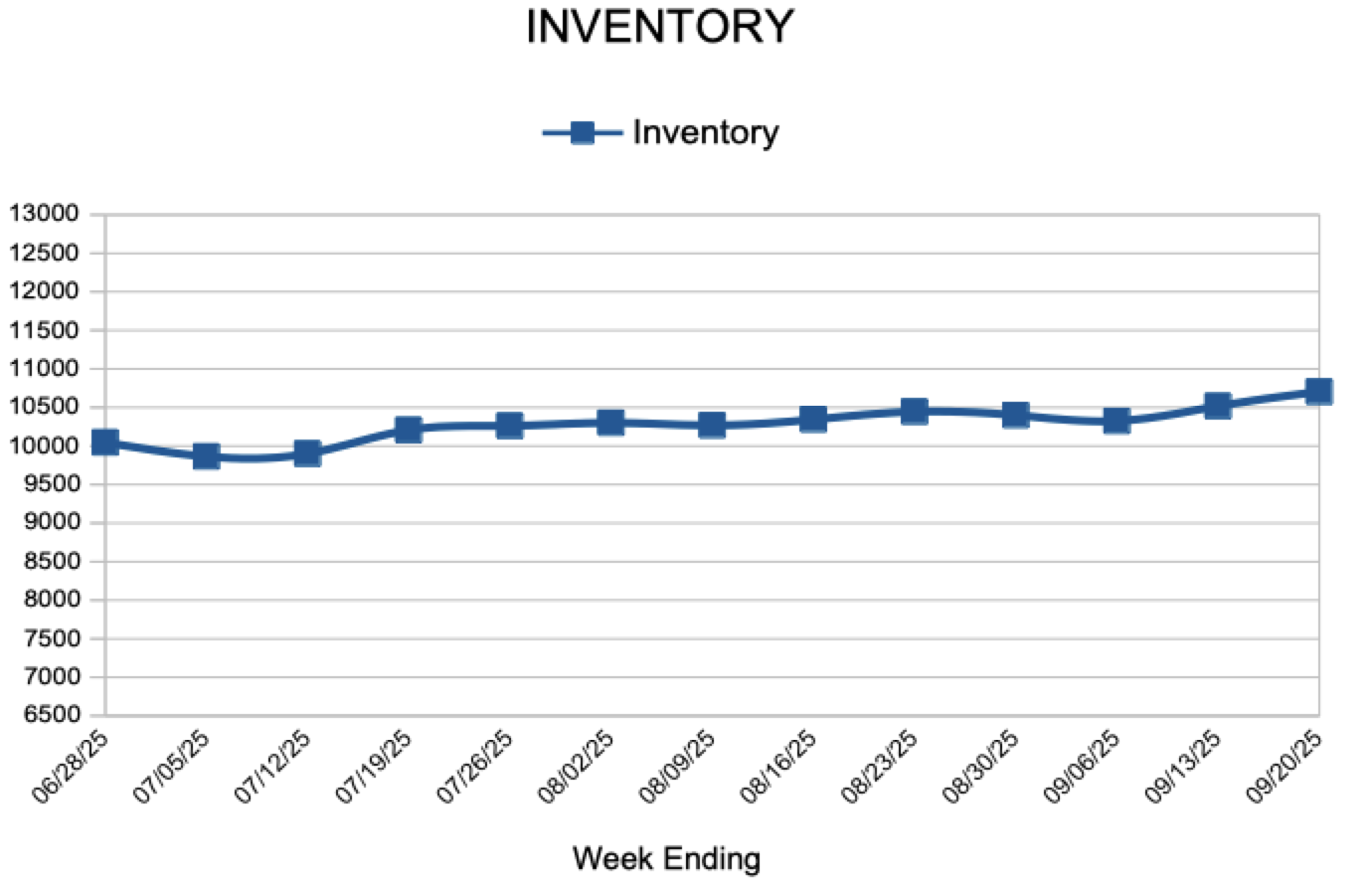

For Week Ending September 27, 2025

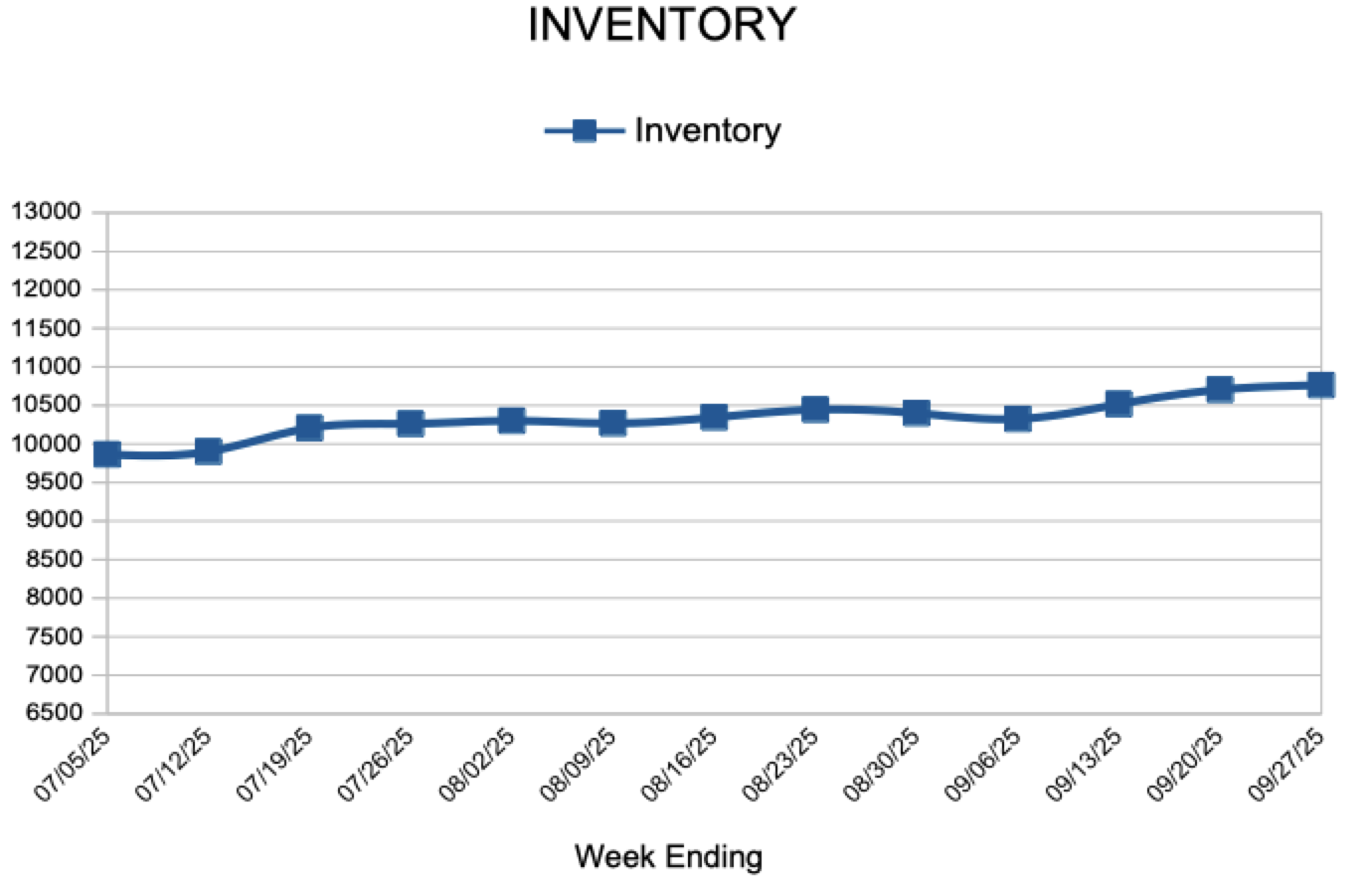

For Week Ending September 27, 2025